COVID-19 Coronavirus Landlord-Tenant Laws, Regulations and Procedures

Landlord tenant laws and procedures in Massachusetts are being amended, suspended, or changed in response to the COVID-19 Coronavirus pandemic. This page was first published in March 2020 to keep MassLandlords members updated on Covid-related issues that may affect their business. It contains all available resources and links.

This page has been frequently updated throughout the pandemic, and is now being updated only as needed.

Massachusetts was entering a state of COVID-19 management and forecast immunity, at least locally, in summer 2021. In fall 2021, the Covid Delta variant created a fourth surge in infections, impacting the national economy. While the Delta variant had subsided somewhat by November 2021, effects and some protocols of the pandemic remained. We have frozen content on this page as a record of what has happened. Please join us in supporting the MassLandlords global team and our friends and family by getting vaccinated if possible and taking care to reduce the spread of this illness to parts of the world that will be struggling with it and losing loved ones for some time yet to come.

What is Still in Effect (as of November 2021)?

Chapter 20 of the Acts of 2021 is a set of extensions to some of the policies in Chapter 257 of the Acts of 2020, An Act Providing for Eviction Protections During the COVID-19 Pandemic Emergency. Section 1 of the law retains the regulation that any Notices to Quit served to tenants must include:

- documentation of tenant-landlord agreements to repay the landlord for nonpayment of rent.

- information on rental assistance programs, including RAFT and ERMA.

- trial court rules pertaining to eviction processes.

- "any relevant federal or state legal restrictions on residential evictions."

The NTQ form must also prominently include the verbatim statement: "THIS NOTICE TO QUIT IS NOT AN EVICTION. YOU DO NOT NEED TO IMMEDIATELY LEAVE YOUR UNIT. YOU ARE ENTITLED TO A LEGAL PROCEEDING IN WHICH YOU CAN DEFEND AGAINST THE EVICTION. ONLY A COURT ORDER CAN FORCE YOU TO LEAVE YOUR UNIT." NTQs must continue to be copied to the Department of Housing and Community Development. These rules will remain in effect until January 1, 2023. Housing courts will grant continuances for applications for rental assistance until April 1, 2022. Also, any properties covered under the CARES Act are required to serve a 30-day notice for nonpayment (not the 14-days allowed in Massachusetts prior to the pandemic). Read more about Notices to Quit.

Some cities have continued local eviction moratoriums. As of November 2021, these include Boston, Malden and Somerville. These moratoriums prohibit landlords from pursuing evictions for nonpayment due to loss of income as a result of the COVID-19 pandemic.

Jump to:

- World Graph

- US Graph

- State of Emergency

- Cleaning

- Masks

- Evictions and nonpayment

- Webinar: Eviction Moratorium, CARES Act

- Presentation: Housing Court Rules in a Post-moratorium World

- Emergency Funding and Stimulus

- Social distancing bulletin

- Mortgage and Expense Forbearance

- Real Estate Closings

- Tax Forbearance

- Unit Maintenance

- Prospective Tenants

- Checking in on Seniors

- Funerals

- Toilet paper bulletin

- Civic Participation: Fair and Equal Housing Guarantee via Surety Bonds

World Graph

Our World In Data has made their graph embeddable here. This graph shows total confirmed cases, not active cases. Some countries have many recoveries.

United States Growth Rate by State

From rt.live August 13, 2020

View rt.live.

- WBUR Map of Active Cases, updated daily

- Expertly prepared graphs for cases worldwide

- rt.live for state-by-state growth rates

Coronavirus: What Landlords Need to Know

The coronavirus pandemic continues to evolve, and the resultant international lockdowns, state shutdowns and mask mandates continue to affect landlords and their renters in several ways. While we have learned much about coronavirus and COVID-19 since early 2020, there are steps landlords should still be taking to help mitigate the pandemic’s effects on their tenants and bottom lines.

Physical health for you and your renters should be your number-one objective.

Vaccines by Pfizer, Moderna and Johnson and Johnson are being administered worldwide by the millions. Booster shots manufactured by Pzizer-BioNTech and Moderna are recommended for large sectors of the population who have received Covid vaccinations. Still, new coronavirus variants continue to emerge, and vaccine efficacies are being adjusted. The Delta variant, combined with a stalled level of vaccination nationally, have again slowed the economy and had an impact on housing. COVID-19 is likely to remain part of our lives for some time, and it remains essential that landlords take precautions to prevent infection. We discuss the required behaviors extensively in this article.

Communicate with Your Tenants About Coronavirus Health

Medical information changes as we learn more. Communicate with your team and especially your renters who do not have internet access, who may still be unaware:

As of April 2021 the CDC said the primary risk factor for COVID-19 was close sustained contact with someone who has symptoms. This means less than six feet apart for more than 15 minutes. Additionally, in March 2021, it updated its operational strategy for school children, stating that three feet apart was considered safe in a classroom environment, as long as students practiced universal masking. It is still recommending six feet of distance for middle- and high-school students who cannot remain in a closed cohort of peers.

It’s in every landlord’s interest to have healthy tenants, and all landlords, from multi-unit property managers to single dwelling owners, should check in with their tenants to ensure that this is known, and what we can do to help keep ourselves safe:

- You should be social distancing, wearing masks, and avoiding prolonged contact with others when not necessary.

- You should be washing your hands before you touch your face, handle food or utensils, or touch someone else.

- It is beneficial to disinfect surfaces, especially after touching them with hands that are possibly contaminated, like after taking in the trash. High-touch surfaces like doorknobs, push plates, car doors, and laundry knobs can all be disinfected regularly for peace of mind. For those who share bathrooms and kitchens, it is vital that they know not to share towels, including hand and dishtowels, and to wash their hands thoroughly after every single use of common areas and devices. Especially consider shared devices such as iPads, remote controls, game controls, stereo knobs, etc.

As of June 22, 2020 it seemed that droplets from close contact with an infected person were the primary means of transmission.

Nevertheless, CDC guidance still requires frequent disinfection of high-touch surfaces.

Strongly consider providing tenants with disposable wipes to keep in common areas for wiping surfaces after each use. You might also provide bottles of disinfectant to promote spraying surfaces often.

Work with tenants to create and/or update emergency contact lists (recommended by the CDC and Massachusetts Department of Public Health) with contact information of two to five people (at least two local) in case of illness or other emergency.

Stay in touch with tenants and let them know to contact their landlord or property manager if they become ill or are diagnosed with or suspect they have COVID-19.

The foremost symptoms of COVID-19 are:

- fever (i.e., temperature of 100.4o F (37.8o C) or greater) using an oral thermometer

- cough

- shortness of breath

These symptoms may appear within two to 14 days after exposure.

In the event you or your employees need to enter rental units, have everyone (residents and team) wear masks; see below. Be careful to note that once you have touched a surface, your hands are dirty and should not be used to touch your face or adjust your mask. Do not eat or drink or bring drinks into the residence. Do not stay within six feet of a resident for more than 15 minutes. Wash your hands immediately after leaving, before removing your mask.

Coronavirus Contingencies

If tenants or employees suspect they have COVID-19 symptoms, they should stay at home and call their healthcare provider (do not travel to healthcare providers or hospitals, it risks infecting others) and follow or await instructions from healthcare providers.

Employees should know not to report to work if they display any illness symptoms or suspect they are sick. If an employee arrives at the workplace displaying symptoms or becomes sick during a shift, that person should be immediately separated from other employees and sent home (not using public transportation).

If employees or tenants do not have a regular healthcare provider, contact the nearest doctor’s office or hospital, explain the situation and seek guidance. Alternatively, call the Division of Epidemiology and Immunization (617-983-6800), explain the situation and seek guidance.

If an individual requires immediate medical assistance, call 911 for an ambulance and inform the dispatcher and emergency personnel of the person’s symptoms.

Cleaning

When source of transmission is known, it has always been person-to-person contact. But the coronavirus can live on surfaces. The half-life is such that a wet sneeze might be able to live for up to nine days on some surfaces (metal, glass, Formica, porcelain, plastic). Smaller amounts will degrade and become non-infectious more quickly. A lab study detected measurable amounts of virus on dry steel and plastic after three days. During the degradation time, the virus is capable of infecting people with COVID-19 when they touch the surface, as they may then ingest the virus by touching their mouth, nose or eyes. COVID-19 is much more powerful than a regular flu, with mortality many times higher. However, the coronavirus can be easily wiped away in twenty seconds with scrubbing with soap and rinsing, or killed in minutes using household disinfectants. (In the event your local stores are sold out of brand disinfectants, the CDC recommends using a diluted bleach solution combining 5 tablespoons of bleach per gallon of water; or 4 teaspoons of bleach per quart of water. IMPORTANT: Never mix household bleach with ammonia or any other cleanser.)

- List of EPA confirmed virucidal cleaners (pay attention to the contact times, the surface must remain wet with cleaner for minutes).

- CDC cleaning guidance

- Considerations for Owners and Operators of Multifamily Housing Including Populations at Increased Risk for Complications from COVID-19

The habit you have developed of washing your hands frequently and thoroughly must remain the new normal. To kill potential coronavirus germs, wash your hands for at least 20 seconds every time after you touch something (e.g., faucet handles, the toilet flusher, subway and bus handles, light switches, silverware, oven and microwave buttons). Be sure to scrub between fingers and thumbs, preferably using soap. In the absence of soap and water, use an alcohol-based hand sanitizer with at least 60 percent alcohol content. If hands are visibly dirty, always wash them with soap and water.

Washing hands frequently and thoroughly with soap and water is one of the most effective ways to ward off coronavirus infection (image by Marco Verch).

Wash often, up to several times per waking hour, and every time after blowing your nose, coughing or sneezing; using the bathroom; eating or preparing food; contact with pets or animals; or caring for another person, such as a child.

Your Rental Units are Clean, but are they Coronavirus Clean?

There’s lots of talk (and rightfully so) about hand washing and hand sanitizing to protect yourself and others from the coronavirus. But what about cleaning? What should you tell your tenants about keeping their units clean to prevent the spread of disease?

How long COVID-19 can live on surfaces, such as countertops and cardboard, is uncertain, and information changes frequently. A study from the New England Journal of Medicine was able to show that the virus can survive for at least three days on surfaces such as plastic and stainless steel. So what does that mean for, say, kitchen countertops and bathroom faucets? What about cell phones and remote controls, or soft-surface things you can’t put in the laundry?

The CDC has published an extensive article on how to clean and disinfect surfaces in the face of this pandemic. The site notes that the primary transmission method for coronavirus is through respiratory droplets (cover your sneezes and coughs!). Still, the CDC recommends you clean visibly dirty or contaminated surfaces, or disinfect them if cleaning is not possible.

Cleaning vs. Disinfecting

It’s important to note the differences between cleaning something, disinfecting it and sanitizing it. (Sanitizing kills or reduces bacteria, but does nothing to kill things like viruses, so we don’t focus on it here). Cleaning and disinfecting are both key components of keeping your home virus-free.

Cleaning removes dirt and other impurities, including germs, from a surface. Twenty seconds of contact with soap and water will kill the novel coronavirus. Soap molecules are comprised of two parts: a head that bonds with water and a tail that avoids water and instead bonds with oils and fat. The coronavirus is surrounded by a protective lipid (fat) barrier. The soap molecules wedge themselves into the lipid membrane and break it apart. This destroys the virus. At that point, the soap traps dirt molecules and the destroyed parts of the virus, and those tiny bubbles are washed away with water.

Disinfecting uses chemicals to kill germs on surfaces. It doesn’t necessarily clean a surface (if you’ve ever used hand sanitizer on dirty hands, you understand the difference), but it will kill the coronavirus. As an aside, despite its name, hand sanitizer that contains at least 60 percent alcohol will kill the coronavirus.

How to Clean

The CDC recommends that you clean or disinfect “high-touch” surfaces every day. Your tenants should focus on things such as tables, hard-backed chairs, doorknobs, light switches, remote controls, handles, desks, toilets and sinks.

If your tenant is concerned that someone with coronavirus has touched something in their home, they should wear single-use gloves to clean and disinfect. If tenants must use reusable gloves, they should only be used for cleaning and disinfecting these surfaces, and nothing else. Tenants should wash their hands after removing the gloves.

To clean surfaces, simply use water and detergent or soap to kill the virus and remove surface dirt. Paper towels may be used, or cleaning rags. Just wash them afterwards.

For soft surfaces, use an appropriate cleaner for that surface. Remove any visible contamination before cleaning. After that, the CDC recommends laundering them in the warmest possible water if possible. If laundering is not possible, it suggests using products with EPA-approved emerging viral pathogens claims to disinfect. A list can be found here.

To Disinfect

There are some surfaces you can’t expose to soap and water. This may include electrical equipment, remote controls, or cell phones. You may also be concerned about contaminants that soap may not be able to kill. In those instances, you want to disinfect instead. The CDC notes that diluted household bleach solutions, alcohol solutions containing at least 70 percent alcohol, and most common EPA-registered household disinfectants should work for these purposes.

Use bleach solutions only on surfaces that they will not ruin. A bleach solution can be made by combining 1/3 cup of bleach with a gallon of water.

A Note on Laundry

Finally, if there is any concern about coronavirus being present on clothes, the CDC cautions that shaking out laundry prior to putting it in the machine can spread pathogens in the air. Follow the manufacturer’s instructions for the articles of clothing, using the warmest possible water. Then, make sure to clean and disinfect any laundry hampers or baskets that came in contact with the clothing.

Wash Your Produce Too: A Bulletin to Your Tenants

"Wash your Produce" was added as of April 9, 2020. Some are choosing not to wash or quarantine their groceries, others are.

As mentioned above, it’s uncertain how long the novel coronavirus can survive on surfaces. That uncertainty also applies to food packaging, which may have been handled by many people by the time you bring items home.

Advice on how to handle this varies. Some people quarantine their grocery store purchases before bringing them into their home. Some might lightly spray a cloth or sponge with disinfectant and wipe down containers. Others don’t seem concerned at all.

At minimum, it’s important to wash your hands before and after handling packaging and, as always, wash your fruits and vegetables. As the virus can survive on cardboard for several days, you may also want to consider quarantining your packages before handling them at home.

The EPA has published a list of disinfectants that can combat COVID-19. The products listed are for use on surfaces only, not for disinfecting your body. The EPA advises: always follow the directions on the packaging of any cleaner, and to observe the amount of contact time the product needs to work. Contact time means the amount of time the item you are disinfecting actually appears wet. Different types of alcohol may take several minutes to properly disinfect something.

If you don’t have access to alcohol-based products (or you don’t have the time to let them work), there’s a simple solution: Use old-fashioned soap and water, which is just as effective, often in less time. Consumer Reports has published an article stating that simple scrubbing can break down the protective layer around the coronavirus. The contact time for soap is around 20 seconds.

In other words, the best way to handle your produce is to give it a good scrub. That’s something you should be doing anyway before consuming it (that includes fruits and vegetables that you peel). And while the CDC reports (Boston Globe story here) that so far, there is no evidence of the virus being transmitted via packaging, playing it safe is still the way to go.

Here are some tips for keeping your home safe after a trip to the market:

- Use hand sanitizer after handling a grocery cart, ideally before you get in your car.

- Wash your hands as soon as you get back home from the store.

- Scrub fruits and vegetables (even the ones you will peel) under water with a soft brush, and soak greens for 15 minutes.

- Keep meats separate from vegetables in the fridge.

- Wash plastic, glass and metal containers with dish soap and water before storing them at home.

- Some other packages (such as frozen vegetable bags, containers of milk, meat in shrink-wrap or cardboard boxes of butter) can be cleaned by wiping them down with a sponge and hot, soapy water. Wash your hands after handling them.

- For packages that you can't easily wipe down (such as boxes of pasta), quarantine shelf-stable packages in a sealed container (such as Tupperware) or an unused room for several days. Wash your hands after handling the packages.

- Make sure to moisturize your hands after to prevent excessive drying or cracking of the skin.

Masks No Longer Required in Public in MA, with Notable Exceptions

On May 6, 2020, Governor Baker issued a statewide order for all Massachusetts residents to wear a mask over their face in public spaces where social distancing is not possible.As of May 29, 2021, the Commonwealth's mask order was no longer in effect. However, masks are still required on public and hired transportation, in healthcare facilities and other settings.

Instructions are available online for how to make a homemade mask.

- Under the right conditions, sneeze droplets can go 23 to 27 feet.

- Even if we’re not coughing or sneezing, exhalations can still contain a gas cloud of viral particles.

Homemade masks will not keep you from inhaling virus particles, but they will prevent you and others from spreading them as widely.

Homemade masks don't keep you from getting sick. They primarily reduce the chance that others get sick.

Recommendation: Ask renters to make and put on a homemade mask prior to and during any maintenance in-unit. Your team should wear a mask in the unit, as well.

Renters: Ask your renters to do two things prior to any scheduled maintenance:

- Wear a mask inside their unit several hours prior to the scheduled maintenance, or avoid using the room to be worked on beforehand; and

- If outside temperature permits, open windows in the room to be worked on, and along the route to get to the room.

Homemade masks will not prevent your residents from inhaling virus particles. Their masks will reduce the chance your team gets sick.

Masks for Maintenance Teams and Contractors

Maintenance teams and contractors should put on masks prior to entering a unit and keep them on for the entirety of maintenance work. This will not keep your team from inhaling virus particles, but it will reduce the chance your residents get sick.

NIOSH respirators will substantially reduce inhalation of virus particles: If your team have been professionally fitted for respirators that they use during dusty construction, if they already have these devices, and if the cartridges are NIOSH Classified N95 or better, you can wear these respirators even during non-dusty work and expect a benefit to the wearer.

Check first that your filter rating meets or exceeds the N95 standard. Deleading equipment and mining equipment usually calls for N100's. Do not purchase medical-grade N95's or respirators at this time. We still have a hording issue. Use only those respirators or full masks that you already have and that were professionally fitted. Let healthcare workers have any remaining items for sale, as their risk is much higher than yours in a random unit. Note: If you adopt this approach, you must learn to remove, clean, and store your mask in a medically safe way. Improper use may concentrate your risk of infection. Note also that beards and heart conditions may make masks useless or dangerous, this is why professional fit-testing is required.

Masks and filters are rated against particles of 0.3 microns, which have the most difficult-to-stop combination of floatiness and weight. Smaller and bigger particles are both filtered more efficiently than this special size. The percentage of particles blocked is for this worst case 0.3 micron size. Wikipedia, NIOSH, Public Domain.

Impact of Eviction Moratorium Laws on MassLandlords Members

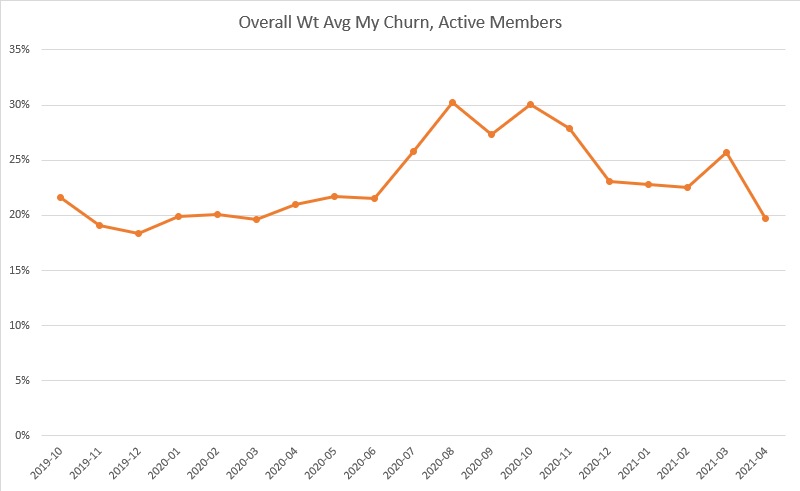

At the height of the pandemic, MassLandlords saw fewer landlords renewing their memberships. However, within a month and a half of the state moratorium lifting in October 2020, landlords seemed optimistic, and non renewal "churn" rate dropped closer to 25%. By April 2021, our membership non-renewal rates were back to pre-Covid numbers.

The upshot? Even after a pandemic and eviction moratorium, people still want to be landlords. Our graph appears below.

State of Emergency End Date

The MA State of Emergency ended on June 15, 2021, and the Massachusetts eviction moratorium was allowed to lapse as of midnight on October 17, 2020.

As of May 5, the Order 13 shut-down of non-essential businesses ran through May 18. Order 13 does not bear on the eviction moratorium.

Evictions and Nonpayment

Massachusetts Eviction Moratorium

The Massachusetts eviction moratorium lapsed at midnight between October 17 and October 18, 2020.

See our in-depth Massachusetts Eviction Moratorium: Full Explanation and FAQ.

Mass.gov evictions and foreclosures forms and other resources for tenants and landlords.

Statistics on the Eviction Diversion Initiative

Get help with rent arrears: A Landlord’s Guide to Massachusetts’ Residential Assistance for Families in Transition Program

Federal Eviction Moratorium on "Covered Properties"

The CARES Act eviction moratorium expired for some properties in July 2020. The 30-day notice requirement had no expiration date. HUD extended CARES Act-like provisions on some properties. Check with an attorney before proceeding with any eviction action.

The Federal CARES Act (stimulus package) ended all Massachusetts late fees and nonpayment filings through July 25, and thereafter changed the notice period for nonpayment from 14 days to 30 days for covered properties.

The language appears to apply overbroadly to all properties that might "in any way" benefit from the existence of federal government involvement in the mortgage market, including most if not all residential and commercial mortgages.

The language clearly forbids all notices and filings, rather than levies of execution (forced move-outs) for 120 days, and then enacts a 30 day notice period for nonpayment (overriding the Massachusetts 14 day notice). There was no exception for renters who continued to earn income through the crisis.

The Violence Against Women Act is believed to extend this prohibition to all Section 8, SSI, and SSDI units even when the property is owned free and clear (not mortgaged).

The federal eviction moratorium superseded the reasonable and nuanced Massachusetts court approach described below. We were still accepting filings in Massachusetts prior to it. We were hearing only emergency cases before April 21st, when the Massachusetts moratorium took effect. On January 20, 2021, President Joe Biden's fist day in office, the CDC moratorium was extended to "at least March 31, 2021." On March 29, CDC Director Rochelle Walensky announced that the CDC eviction moratorium was again extended through June 30, 2021.

Section 4024 of CARES Act reads, in part:

COVERED PROPERTY.—The term “covered property” means any property that—

(A) participates in—

(i) a covered housing program (as defined in section 41411(a) of the Violence Against Women Act of 1994 (34 U.S.C. 12491(a))); or

(ii) the rural housing voucher program under section 542 of the Housing Act of 1949 (42 U.S.C. 1490r); or

(B) has a—

(i) Federally backed mortgage loan; or

(ii) Federally backed multifamily mortgage loan.

The definition of "federally backed" includes the following language:

(B) is made in whole or in part, or insured, guaranteed, supplemented, or assisted in any way, by any officer or agency of the Federal Government or under or in connection with a housing or urban development program administered by the Secretary of Housing and Urban Development or a housing or related program administered by any other such officer or agency, or is purchased or securitized by the Federal Home Loan Mortgage Corporation or the Federal National Mortgage Association.

The terms of the moratorium and new notice period are:

(b) Moratorium.—During the 120-day period beginning on the date of enactment of this Act, the lessor of a covered dwelling may not—

(1) make, or cause to be made, any filing with the court of jurisdiction to initiate a legal action to recover possession of the covered dwelling from the tenant for nonpayment of rent or other fees or charges; or

(2) charge fees, penalties, or other charges to the tenant related to such nonpayment of rent.

(c) Notice.—The lessor of a covered dwelling unit—

(1) may not require the tenant to vacate the covered dwelling unit before the date that is 30 days after the date on which the lessor provides the tenant with a notice to vacate; and

(2) may not issue a notice to vacate under paragraph (1) until after the expiration of the period described in subsection (b).

Which Mortgages are Typically Covered by the CARES Act?

Read your mortgage document to see, and/or call your loan servicer (the person you pay), but generally residential conforming mortgages are all CARES Act covered. A very few commercial mortgages are covered under Fannie Mae's multifamily program (in 2011, $24 billion nationwide, a drop in the bucket). Anything called a "portfolio loan" is likely to be held by the bank, not covered, but check with the bank to be sure.

CDC Eviction Moratorium

The full text of the original 2020 CDC Eviction Moratorium is here:

See updated text for the Spring 2021 extension on the CDC website.

In a nutshell, no landlord could take any action to recover possession for nonpayment if a renter:

- Has made a good faith effort to apply for government assistance to pay rent;

- Expects to earn less than $99,000 individually or $199,000 jointly in 2020; OR reported no income in 2019; OR received a stimulus check in 2020;

- Cannot pay full rent;

- Is paying as much as they can; and

- Would enter shelter or crowded housing following eviction.

The CDC moratorium was extended through July 31, 2021, then lapsed, then was reenacted August 3, then was stopped by court action August 26. As of September 2021, it was believed that the original COVID-19 CDC moratorium was permanently ended.

Violations of the CDC eviction moratorium while it was in effect could still result in a $500,000 fine and a year in jail. Consult with an attorney if you receive notice of violation, even if you did not evict a tenant but instead pursued cash for keys or other mediated agreement for move-out.

Declared Unconstitutional?

Added February 27, 2021:

On February 25, Judge J. Campbell Barker of the U.S. District Court for the Eastern District of Texas issued a declaratory judgment in favor of the Texas Public Policy Foundation holding that the CDC eviction moratorium is unconstitutional.

However, the judge did not issue an injunction prohibiting the federal government from enforcing the moratorium. Instead he relied on statements from the Department of Justice lawyers representing the CDC who said that they “anticipated that the [government] would respect the judgment.”

The onus is now on the Biden administration to either do just that, i.e. respect the order, or appeal the decision. In the meantime, rumors to the contrary notwithstanding, the CDC order remains in full force and effect.

We urge you to understand the penalties associated with noncompliance (read the moratorium for yourself, see above: $500,000 and a year in jail) and consult with an attorney before taking any action that could affect your rights.

U.S. Supreme Court Ruling Ends CDC Eviction Moratorium

On Aug. 26, 2021, the U.S. Supreme Court effectively ruled, via per curiam opinion, in favor of the Alabama Association of Realtors in their charge against the U.S. Department of Health and Human Services (which includes the CDC) that the moratorium was illegal. Some Massachusetts cities have allowed eviction moratoriums to remain in effect. Read a detailed account of the ruling.

CDC Issues Eviction Moratorium for Remainder of 2020 through March 2021 through June 2021

By Kimberly Rau, MassLandlords Writer

References to the CDC eviction moratorium should be read in the context of updates above.

On September 4, 2020, the federal Centers for Disease Control and Prevention (CDC) announced a nationwide eviction moratorium that will run through December 31, 2020. The CDC moratorium effectively extended the existing halt on most evictions that Massachusetts Governor Charlie Baker signed into law on April 20, 2020, which expired on October 17, 2020.

Massachusetts allowed our eviction moratorium to expire in light of the CDC’s national eviction moratorium.

Image credit: eb1 cc-sa Fcb981

“In the context of a pandemic, eviction moratoria—like quarantine, isolation, and social distancing—can be an effective public health measure utilized to prevent the spread of communicable disease,” the CDC stated in a press release announcing the moratorium. It went on to say that an eviction moratorium makes it easier for at-risk populations to self-isolate, and enables state and local governments to more easily enact stay-at-home and social distancing policies.

“[H]ousing stability helps protect public health because homelessness increases the likelihood of individuals moving into congregate settings, such as homeless shelters, which then puts individuals at higher risk to COVID-19,” the press release added.

This action by the CDC prohibits landlords from taking any action to recover possession of their rental property as long as the tenant in question signs a declaration stating that they meet or have met the following criteria:

- The tenant has made a good-faith effort to apply for available government assistance to pay rent;

- The tenant expects to earn less than $99,000 individually ($199,000 jointly) in 2020, or reported no income in 2019, or received a stimulus check in 2020;

- The tenant cannot pay full rent;

- The tenant is paying as much as they can; and

- If evicted, the tenant would be forced to enter a shelter or crowded housing.

Like the expired Massachusetts moratorium, the CDC order is clear to state that rent is still due during this time and that tenants must comply with the terms of their lease. The CDC’s order also does not prohibit landlords from assessing or collecting late fees or interest on missed rent payments “under the terms of any applicable contract.”

The CDC order also does not prohibit states from enacting more strict regulations in the name of public health and safety. This means that even though the state moratorium expired, the national one remains in effect. And if the governor had wanted to extend the state moratorium, he is free to do so.

On one hand, this CDC order states that tenants must swear they meet the aforementioned requirements under threat of perjury. Everyone on the lease is required to sign it. This may make people pause if they have less-than-honest intentions (that is, people who could pay their rent and are opting not to). It also does not prohibit landlords from evicting for reasons other than non-payment of rent.

On the other hand, this order, like the one from Gov. Baker, does not clearly define “eviction.” It states:

“‘Evict’ and ‘Eviction’ means any action by a landlord, owner of a residential property, or other person with a legal right to pursue eviction or a possessory action, to remove or cause the removal of a covered person from a residential property. This does not include foreclosure on a home mortgage.” (Emphasis ours.)

The CDC order does not state whether issuing a notice to quit counts as an eviction, and landlords could face severe consequences for “guessing” wrong. As always, MassLandlords encourages anyone looking to pursue any kind of action against a tenant to consult with an attorney before moving forward. And never attempt something illegal to get your tenants out, such as changing the locks.

Furthermore, we would like to stress that it is important not to try to “work around” the CDC moratorium by terminating “no fault” instead of for nonpayment. For one thing, the CDC moratorium is presently helping to deter an “infinite moratorium” bill that is before the Massachusetts Legislature. If the state sees people trying to work around it, they may see the need to pass it after all.

Instead, try to get your tenants to apply for some of the $100 million in expanded RAFT funding announced by the governor earlier this month. This will keep you in good legal standing and may also help you keep a good tenant who has fallen on hard times once the moratorium expires.

Eviction Moratorium extends to properties with FHA-backed mortgages

In August of 2020, the Federal Housing Administration (FHA) extended its foreclosure and eviction moratorium through Dec. 31. In February 2021, it was again extended, through the end of June. This means if you own a home with an FHA-backed mortgage, you cannot lose your home to foreclosure. An FHA-backed mortgage is one that is insured by the FHA and issued by an FHA-approved lender.

It also means that if you are the landlord of a single-family rental unit that is backed by one of these FHA mortgages, you cannot evict your tenant during this moratorium. The exception here applies to occupants of legally vacant or abandoned properties: These tenants may be evicted. However, all other tenants of FHA-insured single family properties are not to be evicted.

FHA mortgage holders are encouraged to make their mortgage payments during this time. If you are unable to do so, contact your mortgage lender to learn about your options. If you have questions about eviction, make sure you speak with an attorney familiar with landlord-tenant issues.

Massachusetts Housing Courts

Federal law supersedes Massachusetts policy in many ways, see above. The CARES Act provisions were not renewed, leaving Massachusetts court procedure and law the primary eviction moratorium.

The Housing Court has been changing procedure through standing orders:

Standing order 2-20 deferred non-emergency cases.Standing order 3-20 explained what constitutes an emergency.Standing order 4-20 deferred non-emergency cases again.Standing order 5-20 repeals and replaces the above.- Standing order 6-20 repeals and replaces the above, detailing how courts are to operate post-moratorium.

All nonpayment cases were continued by court order even before the state moratorium. This meant no eviction case could proceed even if the legislature had not acted.

Even under the moratorium, landlords could still get emergency cases heard, e.g., restraining orders and certain cause evictions (lease violations related to drug activities, gambling or other illegal activities, MGL Ch 139 S 19). We recommended at that time that landlords call the court before going in-person, hearings were being held over the phone (as of January 2021, hearings were over zoom). The local power to decide what constitutes an "emergency" gave needed judicial discretion to hear restraining orders, escrow motions, and other time sensitive matters. Landlords who needed to file a time sensitive matter would have contacted an attorney for help making their case.

Renters in danger of being evicted from their home could seek a stay of execution (eviction) by filing a motion with the court.

Individuals who were indigent also have access to the e-Filing platform and could file a motion to stay in any of the six (6) Divisions of the Housing Court at no cost, see EOTC Administrative Order 20-3.

All Default judgments entered on March 1st thru May 4th of 2020 shall be vacated upon motion filed with the Court.

In a March 25, 2020, announcement from the Governor:

- DHCD will no longer terminate federal and state rental vouchers.

- MassHousing will boost RAFT by $5 million.

- The Division of Banks (DOB) issued guidance to financial institutions and lenders urging them to provide relief for borrowers and a 60-day stay on foreclosures.

- DHCD asks all owners of state aided low-income housing, including Local Housing Authorities and private owners, to suspend both pending non-essential evictions and the filing of any new non-essential evictions.

- Affordable housing operators are asked to suspend non-essential evictions for loss of income or employment circumstances resulting in a tenant’s inability to make rent.

- Operators should establish reasonable payment plans, notify Section 8 or public housing residents about interim income recertification to adjust rent payments, and to consider offering relief funding for residents ineligible for income reassessment.

CDC plaintiff affidavits must be filed

Before you file a motion or attend a hearing, you as plaintiff must file an affidavit pursuant to the CDC’s eviction moratorium orders.

The affidavit requires you to state the reason you are filing the affidavit (a new summary process action, before a hearing for a non-payment of rent claim, before a judgment is entered in a non-payment case, or when you are requesting an order of execution be issued).

You must also verify whether you, as plaintiff, have received a declaration from your defendant as provided in the CDC order (there is also an option to select if you have received a declaration, but the judge has decided that you can still pursue your case).

The state may update these links or forms in the future. If you follow one of our links and it is broken, please alert us as hello@masslandlords.net.

State Budget Sections 79 and 80: RAFT Eviction Moratorium, Copying Notices

Webinar: Eviction Moratorium, Stimulus from the Coronavirus Aid, Relief, and Economic Security (CARES) Act

To view all of this presentation, you must be logged with webinar access.

To view all of this presentation, you must be logged-in and a member in good standing.

Log in or join today and gain access all presentations and videos

Chapter 257 of the Acts of 2020

A law signed December 31, 2020 changes the procedure for notices to quit for nonpayment. Full article can be read here. Note: The Chapter 257 law has been extended from Jan. 1, 2023, to March 1, 2023 by the April 1, 2022, budget amendment. This delays court cases while an application for rental assistance is pending.

Is it illegal to request or demand rent?

Since the CARES Act, "covered properties" could not serve notices, see "Federal" above. This meant Section 8 and residential mortgages. Parts of this law expired July 31, 2020, with the 30-day notice requirement for nonpayment in covered properties remaining in effect.

Starting April 20, the Massachusetts eviction moratorium made it unlawful to serve any notice to quit. There was a Notice of Missed Payment During COVID-19 Eviction Moratorium landlords could choose to send instead. This regulation expired October 17, 2020.

My renter lost their job. What do I do?

The advice in this section was issued in early May 2020. References to the Massachusetts or CARES Act eviction moratoria should be read in the context of updates above.

Given the unprecedented circumstances surrounding COVID-19, and the fact that Massachusetts now has the toughest eviction moratorium in the nation, rent collection has become an issue for many landlords. Furthermore, as the public debate continues to blame landlords for everything with laws like HD.4935 that would have jailed us, tenants may elect to not pay rent even if they’re still able to. How can landlords pursue rent collection most effectively in these circumstances?

Because many landlords depend on the rent to pay their expenses the same way their tenants may live paycheck to paycheck, we need to be smart during these challenging times. For now, MassLandlords offers the following suggestions for how to adjust your rent collection procedures over the coming months:

1. Carefully consider whether to have a conversation with your tenant about rent

While pushing tenants to pay the entire rent may backfire in some cases, not talking to tenants about paying the rent at all may backfire as well. Putting off a conversation with your tenants about not being able to pay the rent (in whole or in part) will help for those tenants who are finding the means to pay you—but you should be ready at any moment to have the conversation. Consider the following scenarios:

- You may know your tenant’s income has plummeted, their savings are minimal and they won’t be able to pay the entire rent. In this case, it makes sense to initiate a conversation, and sooner rather than later.

- You may expect your tenant can and will pay full rent, in which case you don’t need to initiate a conversation before being paid—but don’t wait until too long after the 1st to reach out if they haven’t paid. If you feel compelled to say something, consider saying: “Please, if your income remains at or near what it was prior to the emergency, continue to pay your rent. Thank you.” If it is true, you could consider adding “as these monies are needed for me to continue meeting my expenses for this building.”

- If you don’t know what to expect, it still makes sense to see what your tenant does first while making sure you are ready to talk—but again, don’t wait too long after the 1st to reach out if they haven’t paid.

2. If you do have the conversation, get your tenant to make the first offer

Assuming your tenant wants to pay as much as s/he can to maintain a stable tenancy, try getting your tenant to talk first. Because your tenant may be feeling quite vulnerable, being able to understand them first, before making yourself understood, can help.

- If you get a sense that they want to make you whole but need to adjust (pay you later in the month or in two installments, etc.), we suggest you try to accommodate this as much as you can.

- If you sense the tenant is looking for concessions (paying less or none in the near future), here are some suggestions for how to do this.Opening line: "I’m hoping we can make a plan that works for both of us. I’m thinking about rent for [this month], but also for the coming months."

- Can you tell me what your situation is? or:

- Yes, I know this coronavirus situation is difficult for us—can you tell me what your own situation is regarding paying the rent?

If it feels right, ask them to talk about their income and savings going forward. Ask them if they can pay the rent but be ready to follow up by asking how much they can pay for the current months and ones going forward. You can gently remind them of the need for both of you to stretch in order to make this work.

Once they offer something, you can counter with a higher amount (but less than the entire rent) to try to reach an agreement. Offering concessions can help them see you as being sensitive to their situations, and may motivate them to stretch for you.

3. Be creative

To help your tenant meet your interests you may need to be creative. You may want to carefully include some of the following talking points:

- Ask them if they have friends, family, coworkers, neighbors, benefactors, etc. who can help them out financially.

- Keeping in mind legal limits on occupancy, perhaps adding a roommate (temporarily) could help (draft agreement should be signed to protect both parties).

- Suggest that, although you have a need to keep their rent payments strong now, you could keep their rent increase low (or offer no increase) for the next leasing period in exchange (again with a proper agreement in place).

- Barter. Offer various tasks/jobs they can do in lieu of paying some/all of the rent (if you do this, it’s best to establish a contract with deliverables according to a timetable).

- Accept multiple payments over the month or over multiple months.

- Offer them a rent reduction if they can pay a higher amount now. For example, if the monthly rent is $1250 and they tell you they can only pay $750/month for the indefinite future, suggest if they instead pay $1000 per month you would withdraw claims for the remaining $250 per month (that is until the situation stabilizes, and with proper agreement). Given the uncertainty of collecting that additional amount later, getting a lower amount now may get you more overall.

- Offer that extra 10-pound bag of rice, your extra cleaning products or anything else you’re confident you won’t need as a good faith gesture (and to help them reduce their costs). You can be friendly, but you’re not necessarily their friend, so be careful about boundaries.

You can make other suggestions to MassLandlords members by emailing us at Hello@masslandlords.net.

4. Establish regular check-ins to update each other given changing circumstances

- Schedule ahead to update each other in order to confirm your plan or revise it if necessary.

- Ask your tenants to communicate with you immediately if their situations change in any way.

5. If your tenant demonstrates need and asks what you can do, say the following in an email or letter:

Mary and John:

I do appreciate how challenging this is for all of us. I’d like to discuss our rent situation, as you have indicated you’re having difficulty with income at the moment. Please know: If this emergency has caused a sudden loss in your income and you do not have sufficient monies set aside to continue paying the rent, I would consider your paying a lower rent amount that adequately matches what you’re able to pay.

Because any reduction in rents collected will directly impact the financial health of the building, it’s helpful for me to better understand your situation. Would you be able to provide:

- documentation as to your loss of income, and

- documentation that you have no additional monies which could be reasonably used

as this can help us negotiate a lower rent. I would also want to review the situation on an as-needed basis in order to assess if/when we can return to the original fixed lease and rent amount. Please feel free to contact me (at _______________) regarding this situation.

I hope this helps. Stay safe.

Sincerely,

Mary Landlord

6. Should you ask your tenants to leave or offer Cash for Keys?

During the Massachusetts eviction moratorium, we said "no." It prohibited landlords issuing any notice to quit or vacate, whether formal or just spoken word desire. We recommended landlords not attempt a voluntary move-out at that time, even if both parties were willing, unless a paper trail showed the renter was the one who had the idea. The renter and other renters would take a better view of their landlord and their handling of this crisis if the landlord operated from an assumption that everyone who wants to continue living in your apartments can do so.

Exception: if renters (especially students) had expressed a desire to move home or to another guaranteed residence, then landlords could consider carefully whether and how best to break the rental agreement.

7. Can I ask for proof of job loss?

Yes, and other proof. Keep in mind that some self-employed, small business, and 1099 employees may not be eligible for unemployment, and therefore will not have proof of having applied for unemployment.

8. What about my bills?

See "Mortgage and expense forbearance."

Send Residents a Bulletin about Social Distancing

Published 2020 April 15:

The Governor of Massachusetts has asked all residents to avoid unnecessary travel and other unnecessary activities during the declared state of emergency. This means no parties; no guests unless essential; no visits to family members unless essential, i.e., for their health and well-being.

The United States response per capita was initially among the worst in the world. Infection spread here quickly. In Mid-March, the World Health Organization confirmed the United States was third behind China and Italy for most cases and has the potential to become the next epicenter of coronavirus. Our social distancing measures have made a remarkable and quick turnaround and we must continue to distance.

In all age brackets, the risk of dying from this disease is about ten times greater than for flu:

https://ourworldindata.org/coronavirus#case-fatality-rate-of-covid-19-by-age

We are close to New York, a state which has more cases than any country in the world. Hospital beds would have exceeded local capacity if not for the intervention of the army corps of engineers. Our proximity to New York makes it likely that we will also remain heavily infected. If we do not social distance, it is likely that we will be unable to treat everyone in Massachusetts who becomes sick. Those of us who are not social distancing will be the sickest soonest. Do not take chances.

Please refrain from unnecessary activities. You can go out to purchase groceries, check in on neighbors, and take a walk for mental health etc. If you have an essential job, you can continue to work outside of your home. Otherwise, you should not go out. Make sure you have the phone number of a primary care physician or urgent care center you can call if you start to experience symptoms:

https://ourworldindata.org/coronavirus

(scroll down to "symptoms")

Unless it is an actual emergency, call before you go to the doctor. If you do experience some symptoms, it is still one hundred times more likely to be the common cold than coronavirus.

Thank you for observing social distancing as we collectively contain this serious illness.

Mortgage and Expense Forbearance

What Are My Options?

April 10, 2020

The $2.2 trillion CARES Act, the emergency stimulus signed into law on March 27, provides protection for home and property owners affected by the COVID-19 pandemic in the form of mortgage forbearances and moratoriums on foreclosures.

“Forbearance” refers to a period in which a borrower is not required to make scheduled payments on a loan, or may make reduced payments, as agreed upon by the borrower and the loan servicer. Forbearance is not loan forgiveness, and borrowers are obligated to eventually pay back in full any payments deferred during forbearance. A foreclosure is the repossession of a property by a mortgage servicer for nonpayment of the mortgage or for other reasons.

But the specifics of these protections are not well defined by the CARES Act. As a result, many property owners, including landlords, are uncertain of their obligations and rights. Who is eligible for a mortgage forbearance? What are landlords’ options when their renters cannot or won’t pay rent, and as a result they can’t pay their mortgages in full?

At the same time, many lenders are also confused about their roles as dictated in the CARES Act.

Mortgage Forbearance

Section 4022 of the CARES Act stipulates that any borrower with a federally backed mortgage is eligible for mortgage forbearance. Federally backed mortgages are those supported by government agencies, including Fannie Mae, Freddie Mac, the Federal Housing Administration, the Department of Housing and Urban Development, the Department of Agriculture and the Department of Veterans Affairs (for those who have served in the armed forces). Overall, about 63 percent of mortgages in the U.S. are backed by a federal agency, according to a report produced the Urban Institute. If you’re not sure whether your mortgage is federally backed, inquire with your bank or loan servicer (i.e., the company you make payments to).

Owners of single-family homes with federally backed mortgages should request forbearance directly from their mortgage servicer. Expect long hold times in reaching your lender, as many people are taking advantage of this option.

The CARES Act allows homeowners to access forbearance for up to 180 days due to circumstances caused by the COVID-19 response. That period may be extended by up to 180 days upon petition by the borrower.

Owners of multi-family homes can request a 30-day forbearance, which may be extended for two additional 30-day periods, according to Section 4023 of the law. Landlords who receive forbearance may not charge their renters any fees or penalties for nonpayment or late payment of rent.

Under this act, mortgage owners who receive a forbearance may not be charged any additional fees, penalties or interest beyond that normally accrued on the loan. Additionally, mortgage servicers are not allowed to require documentation of distress beyond the claim of the borrower requesting forbearance.

Can CARES Act Forbearance Impact my Credit or Prevent Additional Loans?

Yes, this video by Meet Kevin (no affiliation) explains credit impacts in detail:

Kevin didn't actually get screwed (slight clickbait) but the video is very instructive nonetheless.

Non-federally Backed Mortgages

Borrowers with mortgages that are not backed by government agencies may also be eligible for forbearance for COVID-19-related difficulties, though that determination is at the discretion of the lending institution. The federal Consumer Finance Protection Bureau and other regulators have encouraged banks and other mortgage servicers to work with borrowers who are requesting forbearance.

On March 25, 2020, the Massachusetts Division of Banks issued guidance to financial businesses across the Commonwealth to accommodate requests for mortgage forbearance for 60 days or more, to waive late payment fees, and to refrain from reporting late payments to credit bureaus.

Raphael Williams, press secretary and senior communications adviser for the Federal Housing Finance Administration (FHFA), estimated that about 90 percent of mortgage holders requesting forbearance will be accommodated with some kind of forbearance option.

Forbearance Payback

Importantly, mortgage forbearance does not mean forgiveness, and any recipients of forbearance will be responsible to repay amounts due during the forbearance period eventually, with accrued interest. In some cases, that may mean the full amount of the missed payments will be due at the end of the forbearance. If your forbearance is for 180 days – or 360 days for those who extend the initial period – a lump-sum payment due for tens of thousands of dollars could be waiting at the end.

The payback schedule depends on lending institutions’ policies and what borrowers can negotiate. Some lenders may tack the amount of missed payments during forbearance on the back end of the loan (i.e., the loan period will be extended by a period equivalent to the forbearance duration). Others may work with borrowers to temporarily increase monthly payments when they resume until the deferred amount is paid off.

Borrowers should work with their lending institutions to formulate a viable repayment schedule.

Moratoriums on Foreclosures

The CARES Act also established a national moratorium on mortgage foreclosures for 60 days, beginning on March 18, 2020. Under this provision, mortgage lenders were prohibited from initiating or finalizing any foreclosures.

The foreclosure moratorium did not apply to vacant properties.

CARES Act and Commercial Mortgage Holders

Commercial mortgage borrowers are not included in the CARES Act’s forbearance allowances. However, government support comes in the form of small business loans (see below for details) to help commercial landlords cover their property expenses, including mortgage, in the event their tenants are unable to make their rental payments.

Should I eat or pay my mortgage?

Recommendation: Save money for food and essential repairs. As of January 2021, additional federal and state assistance was incoming.

Real Estate Closings during Coronavirus

Registry closures leave us strongly recommending you attempt to obtain gap insurance, to cover the time between a property may be transacted and the deed may be recorded.

SD2882 needs support to permit notarized closings to happen via video conference, instead of in-person.

Read more updates on the Massachusetts Real Estate Law blog.

Tax Forbearance

As of February 2021, no real estate tax or water bill forgiveness had been enacted. Check with your municipality to see if there is a forbearance program in place (some like Boston did have one for a time).

The Largest Stimulus in U.S. History: A Summary

After some back and forth between political party lines in late March 2020, the federal government passed a $2 trillion economic relief package as a step to help keep the economy afloat during the coronavirus pandemic. And while the Coronavirus Aid, Relief, and Economic Security (CARES) Act earmarked some funding for hospitals and big industries (the airlines received some $32 billion in grants for wages and benefits), a portion of the stimulus is being funneled directly to the American people.

For the full text of the bill, click here.

Unemployment gets a boost

A federal boost to unemployment benefits allowed those who lost jobs to collect up to $600 more per week on top of whatever their state allotment would be. That provision expired in July. However, the state applied in August for a federal program enacted by President Trump through an executive order to extend additional benefits of $300 on top of state unemployment payments for a period of three weeks.

Historically, independent contractors, the self-employed and people who work in a gig industry (such as driving for Uber) have not been eligible for unemployment benefits. This changed under the CARES Act, with self-employed, independent contractors and gig workers eligible for federal relief. Massachusetts' unemployment website outlines these benefits. These benefits are available for up to four months.

Finally, unemployment benefits at the state level have been extended, from a previous 26-week cap on benefits to 39 weeks. This extension is valid through December 31, 2020. The waiting period for benefits, typically one week, has also been waived, as has the work history requirement. That means even if your tenant lost a job they just recently acquired, they can still collect benefits.

Stimulus Checks

Under the CARES Act, most adults received $1200 ($2400 per couple), with an additional payment of $500 per qualifying child under age 16. This one-time benefit was made available to any adult who made less than $75,000 in 2018 (or 2019, if they have already filed those taxes), $150,000 per couple. The amount then gradually decreases as people’s earnings increase—single people earning $99,000 or couples earning $198,000 would not receive a payment.

Relief for Small Businesses

The CARES Act allowed the Small Business Association to offer a 100 percent guarantee on up to $349 billion in loan money.

These disaster assistance loans could be used to cover payroll, rent or other business-related bills. The program ran through June 30, and portions of the loan may not need to be repaid (for instance, up to eight weeks’ worth of payroll may be forgiven). Payout could be within two weeks for these loans, though some are reporting the site to apply is quite slow at times.

State and Federal Assistance for Small Businesses

April 7, 2020

Small businesses in Massachusetts have, in theory, a few options for covering costs to help offset revenue losses due to the coronavirus pandemic response. And unusually, small business in this case includes freelancers, gig economy workers and sole proprietorships.

The ongoing question is whether small businesses – many of which operate with only weeks’ worth of capital – are able to obtain funding soon enough to avoid layoffs, pay utilities, rents and mortgages, and remain solvent.

Procuring ample funds may still be delayed for many due to several reasons: government agencies are overwhelmed with small business loan applications; government funding has not been equal to the massive wave of need; and confusion among lenders and applicants about these quickly produced loan programs have muddled their early progress.

Rough Start for SBA Payroll Program

The U.S. Small Business Administration’s (SBA’s) Payroll Protection Program,

which launched on April 3, provided nearly $350 billion for American businesses with fewer than 500 employees. The loan program, a cornerstone of the $2.2 trillion CARES Act (read an overview of the CARES Act), was targeted primarily toward helping business owners retain their employees at full wages.

A prominent feature of the Payroll Protection Program (PPP) was a 100 percent forgiveness of the loan, provided the funds had been used for payroll, rent, mortgage interest and utilities. Loan forgiveness was contingent on employers retaining all of their employees without reducing their wages. Forgiveness also required that employers use at least 75 percent of the loan funds for payroll. Any necessary loan payments were to be deferred for six months.

The PPP was available through June 30, 2020, for any small business, including sole proprietorships, independent contractors and self-employed people.

Thousands of banks throughout the U.S. have participated in administering these SBA loans.

Many lawmakers and business advocates agreed that the total allotment for the program was not sufficient, and that more government funding for small businesses will need to follow.

Mass. Business Loans

The Small Business Recovery Loan Fund, a $10 million program announced by Governor Charlie Baker on March 16, was created as a lifeline for businesses across the state with fewer than 50 full- and part-time employees, including non-profit businesses. The program was capitalized and administered by the Massachusetts Growth and Capital Corporation (MGCC). The MGCC was quickly overwhelmed with applications and ceased accepting new applicants on March 19. On March 20, the state approved an additional $10 million to meet the demand of program applicants.

The MGCC now refers small business loan applicants in Massachusetts to apply for the SBA’s Economic Injury Disaster Loan (EIDL), a much larger program that allows borrowing up to $2 million. Gov. Baker successfully petitioned the SBA to allow Massachusetts business owners who have experienced economic injury due to the coronavirus pandemic to apply for the program.

These EIDL loans are allotted with a 3.75 percent interest rate (2.75 for nonprofits) and with long-term repayment schedules, up to 30 years. The deadline for application is set, for the moment, for December 18, 2020.

The SBA also offers a loan advance of $10,000 for those who have been approved for the EIDL loan program. The advance is available immediately and does not have to be repaid.

Local Grants

Several Massachusetts cities have stepped forward with grant funding for small businesses struggling from coronavirus-related revenue losses.

Worcester, Fitchburg and Cambridge have so far established grant programs for small businesses, ranging in aid from $6,000 (Cambridge) to $10,000 (Worcester). The grants, administered through the cities’ Community Development Block Grant programs, carry different, though similar, stipulations for applicants. For one, the grants require that businesses can document evidence of income loss beginning in March with coronavirus-related business closings.

These grants will not require repayment as long as the grant stipulations are met.

Boston is being called on to implement a similar small business grant program.

Other SBA Loan Options

Small businesses in Massachusetts that already have a current credit relationship with a preferred SBA lender may also apply for an Express Bridge Loan. This pilot program allows small businesses to access up to $25,000 quickly in order to bridge expenses while awaiting other funding or reopening.

The SBA is also offering a debt relief program for small businesses that already have 7(a) loans. (SBA 7(a) loans are a popular funding vehicle for small businesses in which the SBA provides lenders with a backup guarantee of repayment for applicants with insufficient business credit history.) Under this program, the SBA will cover principal and interest on 7(a) loans for six months beginning March 27, 2020.

Tax Relief

On March 18, 2020, Gov. Baker announced state tax relief for small businesses, particularly those in the restaurant and hospitality sectors. Under this provision, collection of sales, meals and room occupancy taxes were to be suspended for the months of March, April and May 2020. The due date for such taxes was set for June 20, with penalties and interest waived.

Guidelines for Property Managers

Employees and property managers overseeing multi-unit buildings and complexes need to be especially vigilant around coronavirus protocols. They must be direct and clear in imparting protocols to renters, using prominent signage, email notices and other communications as needed.

Cancel any resident gatherings in common areas, such as meet-and-greets and other social events. Restrict laundry area usage to one unit at a time to avoid in-person contact. Increase daily cleaning of common areas, taking special precautions to wipe down commonly touched surfaces.

Check in frequently with elderly residents and anyone who is at risk. Discuss a communication plan for elderly and at-risk tenants and any tenants who are sick.

Update all tenants’ contact information and add pertinent emergency contacts.

Maintenance during the Coronavirus Pandemic

All non-essential maintenance should be deferred. Some municipalities (e.g., Worcester) have already stopped sanitary code enforcement except for immediate dangers to health and safety.

Some daily maintenance will have to continue to retain a hygienic environment in multi-unit rentals. Trash disposal is one of those jobs. Managers should treat all trash from rental units as hazardous waste to be disposed of with extreme caution.

Managers who are called and need to enter units for specific emergency maintenance jobs must be sure to follow employee guidelines of washing hands before and after entering the unit, disinfecting all surfaces touched, and keeping their distance from residents. Non-emergency jobs should be deferred.

The fewer people who need to enter rental units, the better.

Defer any maintenance jobs—e.g., routine inspections, filter swaps, gutter cleaning, caulking and grout filling—that are not of immediate necessity for at least 30 days, pending further information.

If professional subcontractors are needed, establish a Standard Operating Procedure (SOP) and clearly communicate it to contractors entering the rental premises. The SOP should include at least: meeting with the property manager or owner before entering any rental units; washing hands before entering units, perhaps wearing latex gloves; disinfecting any touched surfaces; and remaining at least six feet away from any residents or others on the property (no shaking hands!).

If contractors display any signs of COVID-19 or other illness, send them away from the property and reschedule for another time or with another contractor, again following SOP.

Working with Prospective Tenants

Business must go on as much as possible, and even in a pandemic people will be seeking places to live. The same guidelines for subcontractors and other visitors should be followed when working with prospective tenants who want to visit a multi-unit complex.

Pre-screen any potential renters before showing units to determine if they have recently traveled or are showing signs of sickness. This can also be used to qualify the prospects as viable tenants with immediate housing needs. Limit showings in common areas and minimize exposure to other residents. Open all doors before a showing and close doors afterward to avoid touching of handles and doorknobs. Instruct prospects to look only, not to touch any surfaces, not to use bathrooms or faucets inside rentals, and not to have any food or drinks inside rental units.

As always, be sure to adhere to Fair Housing laws. Disinfect all areas of the rental unit after showings.

Can I show a rented unit?

Legally, yes. Recommendation: Do not show rented units. Accept vacancy as a cost of doing business. Get pictures or video for virtual tours. Do not bring a parade of strangers into an occupied household; you could experience liability lawsuits afterwards for spreading infection if anyone were to become ill.

Are there rental agreement clauses I should add?

Yes, we are recommending members utilize our optional "90 day delay in occupancy" clause to encourage landlords and renters to sign rental agreements even when move-in dates remain uncertain for the indefinite future. See Optional Clauses AD. DELAY IN OCCUPANCY. We are grateful to Attorney Jordana Roubicek Greenman of JRGLegal and Attorney Richard Vetstein of the Massachusetts Real Estate Law Blog for this contribution.

Check in on Seniors for Their Health

Seniors are statistically the people most vulnerable to the dangers of COVID-19. Fatalities from the virus are highest among people aged 85 and older, according to CDC statistics, followed by those aged 65–84.

But checking in on seniors – renters, friends, neighbors, family – during this pandemic can make a big impact on their overall health. Checking in in this case, however, means utilizing methods other than face-to-face contact (unless it’s a raised-voice conversation from their front porch to the sidewalk): Internet, smartphone and landline telephone.

Checking in on seniors via Internet, smartphone or landline telephone can improve their mental, physical and emotional health substantially. Licensed Pixabay, Jérôme Choain.

Seniors’ difficulties in this pandemic may be compounded by several factors that further isolate them. A higher percentage of seniors have no Internet service or do not use computers, for example. Also, many seniors live alone, far away from family and with limited social networks.

For seniors, this period of social distancing and isolation can result in depression and loneliness. This may trigger serious long-term health effects, exacerbate chronic maladies and increase the likelihood of detrimental behaviors such as smoking or abusing alcohol. And some seniors might potentially miss or misunderstand important health directives that could endanger them and others if not followed correctly.

Landlords with senior renters should follow the advised protocols here to establish and maintain communication by means other than in-person contact. For tenants with email or texting capabilities, sending a note online is simple enough. Group email chains or texting groups might help them feel more like part of a community.

Those who don’t use computers or smart phones may prefer the old-fashioned landline telephone. But even in those cases, you could set up and include them in a phone chain or conference call for a group conversation with other seniors and friends. It might go a long way toward helping seniors feel less isolated.

Online Options for Seniors’ Mental, Physical, Emotional Health

If at all possible, having Internet access is the most optimal way for seniors to weather this period of mass isolation. The Internet isn’t just a way for seniors to stay in touch with people while avoiding physical contact, offering instant messaging, email, streaming services and other means of communication. It also offers countless sources of information for keeping apprised: exercise videos, including stretching and yoga sessions, which will help maintain muscle and balance, reduce stress and protect from falling; guided meditations and music for relaxing; and enough movies to outlast any pandemic.

Many seniors also use Internet subscription services to access life-saving fall monitoring devices, interact with smart home assistants like the Amazon Echo, automatically program their home thermostats, set home security controls and access other safety and convenience options.

Helping Seniors Get Online

Seniors already using the Internet can be easily guided and introduced to new online services. A majority of seniors, even if they don’t use a computer, are using smartphones. This period of social distancing may be the time for them to learn about the many ways their phones can assist them.

During check-ins, you might assess what services they are using and recommend those they could benefit from. Of particular value now are smartphone apps for food delivery, such as Amazon Fresh, Instacart and Peapod.

If you know seniors who subscribe to a cable service for their television or telephone, or have Wi-Fi in their homes for smartphone use, you might assist them in contacting their cable subscriber to upgrade their service to include Internet, at least temporarily.

Several Internet Service Providers (ISPs) are offering low-cost services (as low as $10 per month) for seniors, typically with no monthly contract required, as a coronavirus contingency. Check service providers in your area for their discount services for seniors. In Massachusetts, that likely means Comcast and Spectrum, but several local ISPs are also offering discounts.

Non-Internet Alternatives

If seniors you know do not have computers or smartphones, or simply won’t or can’t use online services, but will still use their landline telephone: help them. Be available to take and place online delivery orders, explain safety procedures, talk through an exercise or stretching routine, be a companion, and provide numbers of places to call for delivery orders.

As a last resort, if you can’t reach a senior by phone and you feel a need to check in on them in person, exercise extreme caution. Remain separated if possible, communicating from each side of a screen door, for example, or while standing at least 10 feet apart. Keep your distance and have absolutely no contact. Wash your hands before and after your visit, and try not to touch anything near the entrance to their residence.

If you receive no response to knocks on the door or repeated phone calls to seniors you know, you might report this to the local police, or request a police wellness visit. Depending on the municipality and its police department coronavirus polices, they may request more information from you, advise various actions or meet you at the senior’s residence, equipped with CDC-recommended PPE, for a check-in.

Even before the new coronavirus shuttered businesses and sequestered society behind doors, seniors as a demographic were already feeling isolated, many lacking regular companionship. That feeling increases among those experiencing mental or physical illnesses, hearing loss or poverty.

A simple, periodic check-in during this pandemic can provide an important boost to seniors’ physical, mental and emotional health and help them weather this period of isolation.

Funerals in the Time of Coronavirus

The American funeral looks much different during a pandemic