The Trump Administration released additional details on how it plans to dole out $16 billion in subsidies to select farm businesses in order to mitigate continued economic damage caused by the president’s imposition of tariffs on goods imported from China. The administration will circumvent Congress and instead use legal authority that originated with Franklin Delano Roosevelt during the Great Depression to borrow $16 billion through the federal entity known as the Commodity Credit Corporation. This $16 billion, $14.5 billion of which will be checks sent directly to select farm business owners, marks the second consecutive year for these bureaucratic bailouts. This despite Agriculture Secretary Perdue and others within the administration stating trade assistance would only be for one year and is for “short-term cash flow issues.” The trade war, and the government’s use of tax dollars to paper over the negative outcomes, is anything but short term.

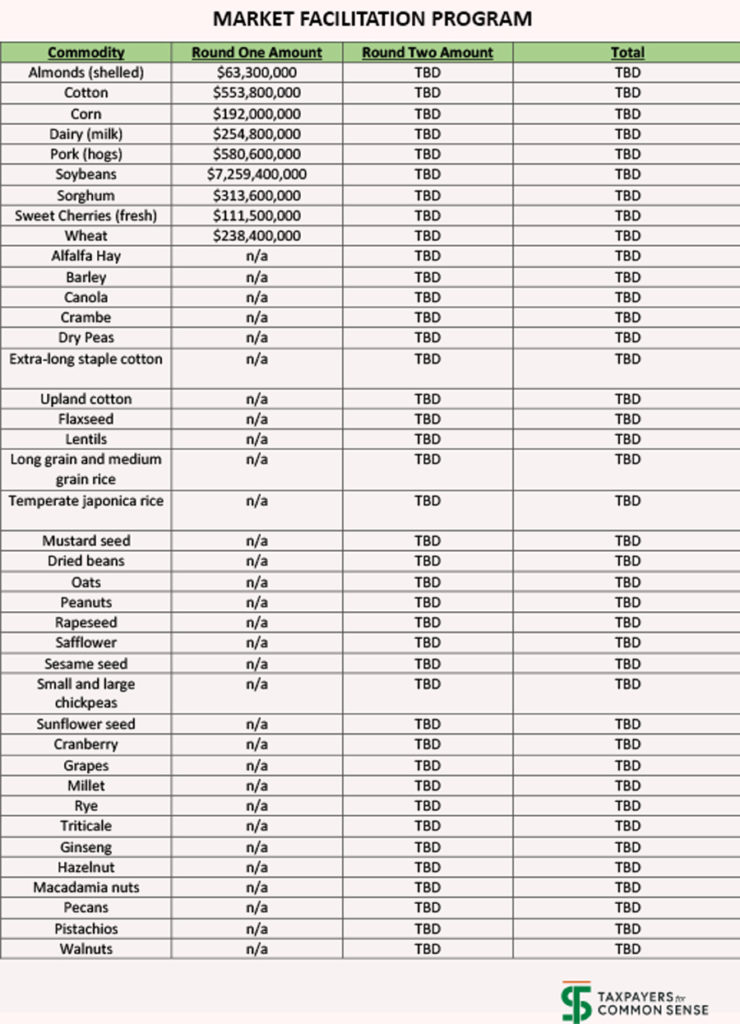

Market Facilitation Program

Subsidy Checks Mailed Directly to some Agricultural Businesses = $14.5 billion

The majority of the $16 billion in deficit-financed spending will be in the form of “direct payments” sent to farming and ranching businesses that produced particular crops or livestock. These crops include all so-called “covered commodities,” crops that are currently eligible for other Farm Bill subsidy programs (Agriculture Risk Coverage and Price Loss Coverage), as well as milk, hogs, and various tree nuts and fruits. Payments will be made in three batches (mid to late August, November, early January). Individual payment limits and income tests apply.

- Eligible Crops and Livestock: Growers of 38 different crops and livestock are eligible for income subsidies. Notable newly eligible crops include alfalfa hay, all oilseed and pulse crop commodities, various tree nuts, ginseng, cranberries, and fresh grapes.

- Direct payments for the first round of MFP were limited to nine crops: soybeans, corn, cotton, wheat, sorghum, milk, hogs, almonds, and sweet cherries.

- USDA’s calculation of harm: USDA calculates trade damage on a county-by-county basis. They have not released details on their formula. It has been reported USDA used a 10-year lookback at export levels for each commodity and picked the year with the greatest export level as the baseline from which they determined lost exports. The details are expected to be disclosed soon.

- For the first round of MFP, the USDA calculated harm by subtracting the 2017 trade value of the commodity without the retaliatory tariff from a particular country by the 2018 trade value of the commodity with the retaliatory tariff from a particular country. Then dividing that number by 2017 production numbers of that commodity.

- Payments based on planted acres: Payment calculations are based on the total amount of eligible crops an individual producer reports he or she plants prior to August 1. Acres for which a producer received a “prevented plant” crop insurance claim can still be eligible for a $15 per-acre MFP payment if the acreage is planted with a cover crop before August 1.

- Payment rates in MFP round one were based on the actual harvested amount of a crop. This harvested quantity was multiplied by a specific dollar amount that varied by crop. Producers who did not harvest a crop were not eligible to receive MFP.

- Payments for specialty crops will be based on the number of acres of those crops bearing fruit or nuts in 2019. These crops include sweet cherries, cranberries, fresh grapes and six different tree nuts. Ginseng growers will receive payments based on their harvested production.

- Payment rates: Payment rate is set at the county level and calculated by USDA. Every acre planted to eligible crops will receive a payment, regardless of which specific crop is planted. A map of county payment rates was released here. The cover crops that are planted for harvest following a prevented planted crop must be planted no later than August 1, 2019. Acreage planted to cover crops and non-specialty crops planted after August 1, 2019, is not eligible for assistance under MFP.

- For the first round of MFP, payment rates varied by crop, was based on actual harvested amount of that crop, and was uniform nationwide. For example growers of soybeans received $1.65 per bushel of harvested soybeans while corn growers received $0.01 per bushel of harvested corn.

- Individual payment limits: There are three separate payment limits based on the type of crops or livestock being raised. Payments are limited to a combined $250,000 for non-specialty crops per person or legal entity. Payments are also limited to a combined $250,000 for dairy and hog producers and a combined $250,000 for specialty crops. In addition no applicant can receive more than $500,000 in total.

- MFP round one established a $125,000 payment limit (the same limit that applies to Farm Bill subsidy programs) for crops and a separate $125,000 limit for livestock/milk, for an aggregate limit of $250,000 per individual. USDA’s, however, chose to continue allowing producers to exploit the “active management” loophole to avoid payment limits. The “active management” loophole allows numerous individuals involved in one operation to each claim a separate payment limit by claiming to provide management decisions on a farm, with no requirement they actually live or physically work on the farm. This loophole allowed over two hundred farms to receive at least $375,000, in MFP round one payments, with one farming operation receiving $2.8 million.

- Income Means Test: Producers must have an average adjusted gross income (AGI) less than $900,000 for the years 2014, 2015, and 2016 to be eligible. This requirement IS WAIVED if at least 75 percent of an individual’s income is derived from farming or ranching, then there is no limit on their adjusted gross income.

- MFP round one originally applied the $900,000 AGI means test without exception. The waiver of AGI means test for producers making at least 75 percent of their adjusted gross income from farming and ranching was retroactively applied by the 2019 Disaster Supplemental adopted June 6, 2019.

- Timing and structure of payments: County payment rates range from $15 to $150 per acre, depending on the impact of unjustified trade retaliation in that county.

- MFP round one payments were doled out in two tranches. The first half of payments were made starting in September 2018. USDA made the second half of potential payments contingent on whether economic damage was still occurring during the latter half of the year. Surprising no one, on December 17 the USDA unleashed the second tranche of MFP round one payments.

- Total eligible payment acres cannot exceed the total acres planted to all eligible crops in 2018.

- The first round of payments were based on actual harvested production in 2017.

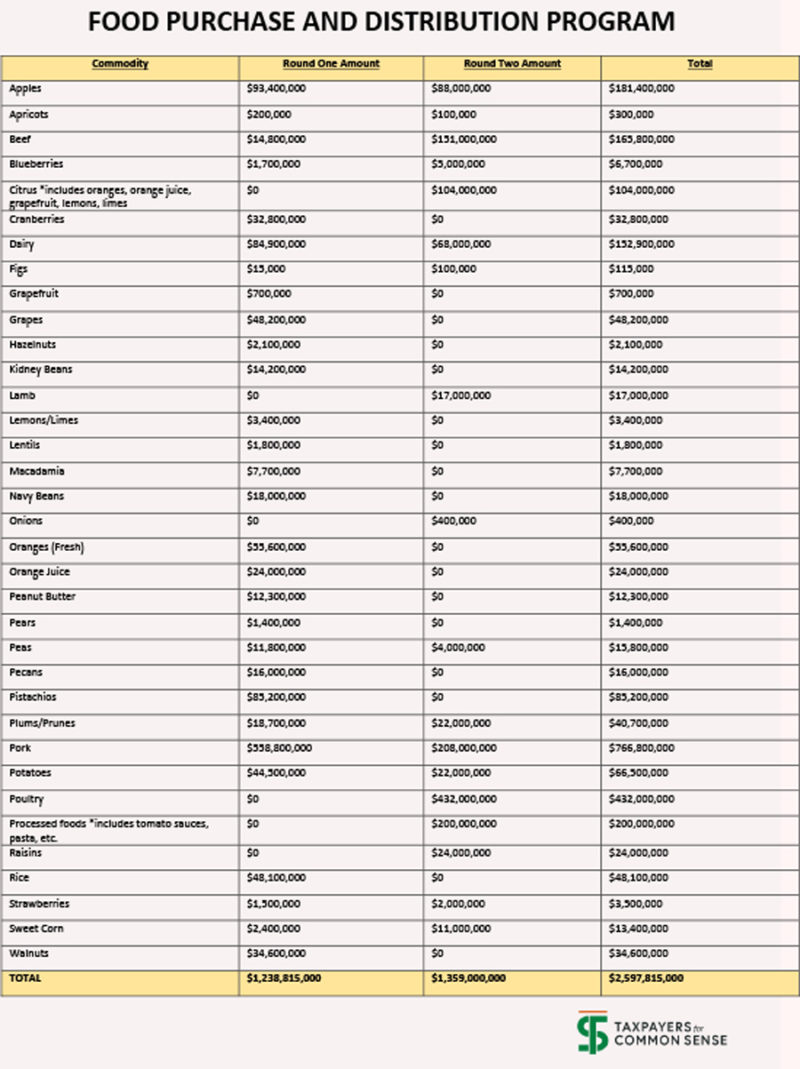

Food Purchase and Distribution Program

Government purchasing commodities in order to remove them from the market = $1.4 billion

The USDA will spend $1.4 billion purchasing “surplus” commodities and distributing them to food banks, schools, and other outlets serving low-income individuals. The intention is to increase prices consumers pay for these commodities by decreasing the availability of these commodities.

- USDA specifies it will purchase at least 21 different types of products fruits, vegetables, meats, milk, and processed foods.

- Some items explicitly listed for purchase this round such as lamb, onions, poultry, and raisins were not purchased in the FPDP Round one.

- “Various processed foods” is a very broad category that could open the door to numerous products beyond the orange juice, peanut butter, and multiple dairy products USDA is currently purchasing.

- Purchases will begin starting after October 1, 2019 with deliveries beginning in January 2020 and will occur in four phases.

- USDA has not actually completed all purchases under the initial round of FPDP.

- Round one of food purchases cost taxpayers $1,238,815,000. Nearly half of that (45 percent) purchasing pork.

- Numerous commodities matriculated out of the direct government purchase program and into the direct government payment program. This includes cranberries, grapes, hazelnuts, macadamia, navy beans, pecans, pistachios, rice, walnuts, and lentils.

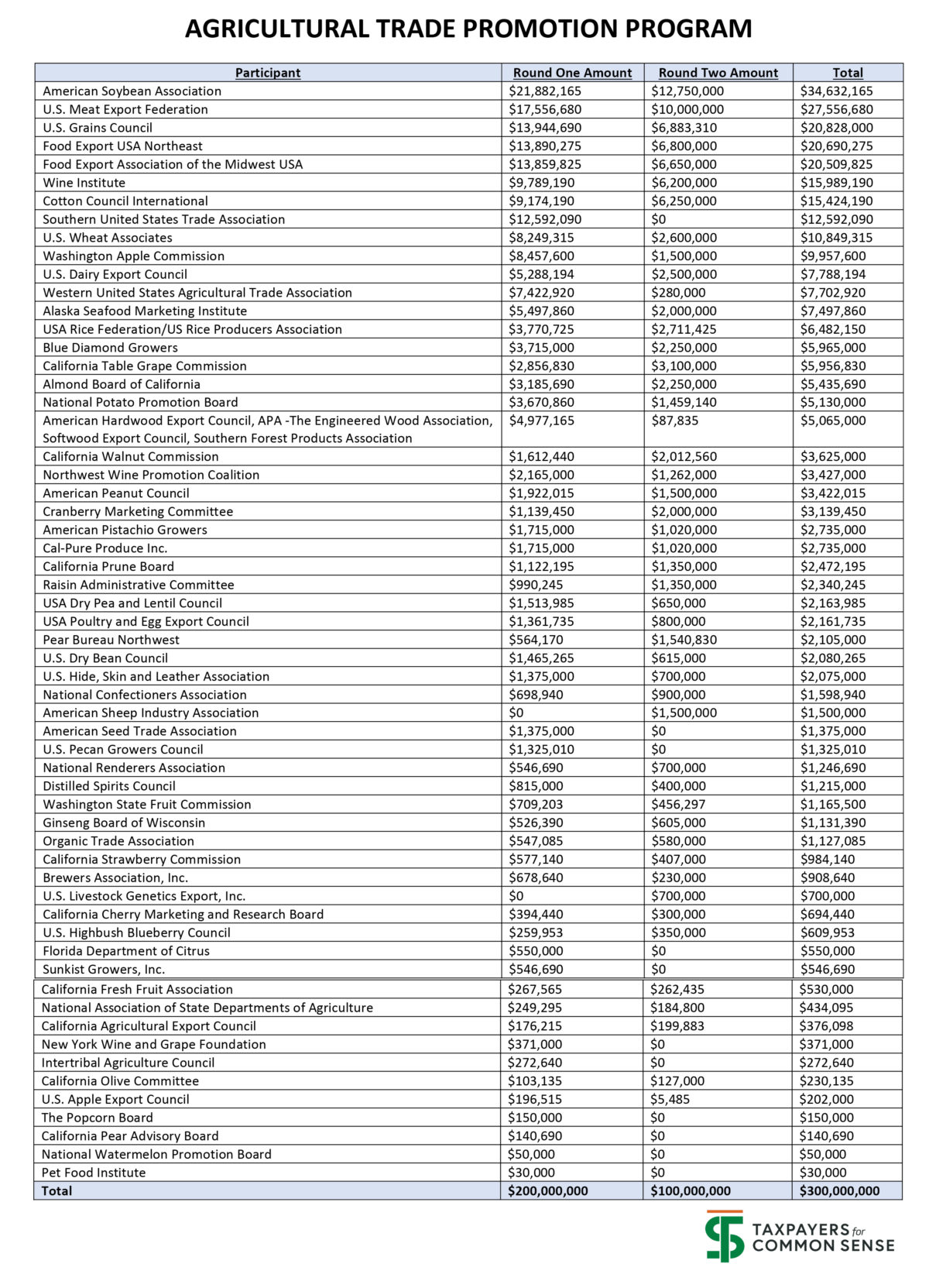

Agricultural Trade Promotion Program

Opening markets with the left hand after closing them with the right = $100 million

The USDA will give $100 million to 48 organizations and trade groups to develop new markets lost by the trade war.

- During round one of trade aid, the USDA doled out $200 million to 57 organizations to help U.S. agricultural exporters develop new markets.

- Organizations that received taxpayer dollars included the Brewers Association, Inc., the Pet Food Institute, and the Wine Institute. The USDA announced on July 19 where the $100 million will go. Overall, the American Soybean Association has received the most taxpayer dollars through the program ($34,632,165).

The agriculture sector is at the mercy of Washington

Overall, the $28 billion in hush money is only a bandage that won’t fully replace lost sales. Agricultural exports, historically a perennial bright spot even in the darkest of times, fell 4.4 percent from last year. An already challenging price and income environment was then made more difficult by the wettest year on record, which led to $5 billion in deficit financed subsidies going to ag producers in two supplemental disaster bills, including for the cost of soybeans stored on farm; soybeans that would have been sold if not for the trade war.

For agricultural businesses it appears the most detrimental cost of the Trump Administration’s trade war is the dusting off of Depression-era law to increase Washington’s role in picking financial winners and losers within agriculture. Instead of dismantling burdensome regulatory barriers and arbitrary mandates that prevent farmers and ranchers from operating businesses according to their own abilities, estimates and values, the administration has shown a willingness to replace trade with federal aid. The Market Facilitation Program is here to stay. And it will harm both taxpayers and agriculture.

Get Social