Markets

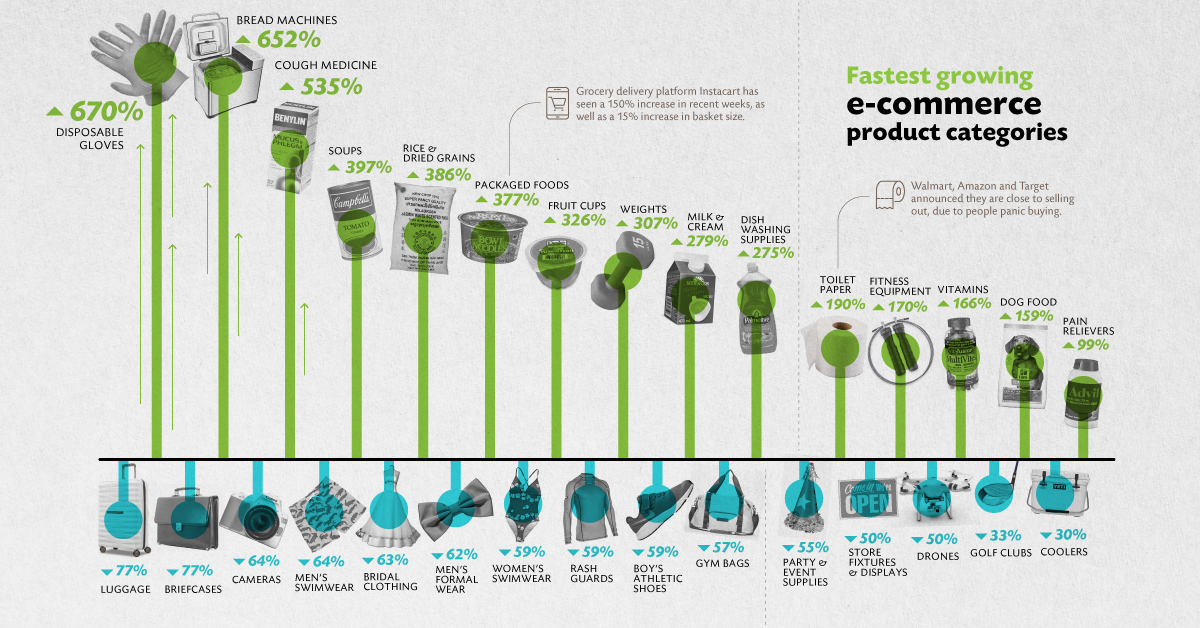

The Pandemic Economy: What are Shoppers Buying Online During COVID-19?

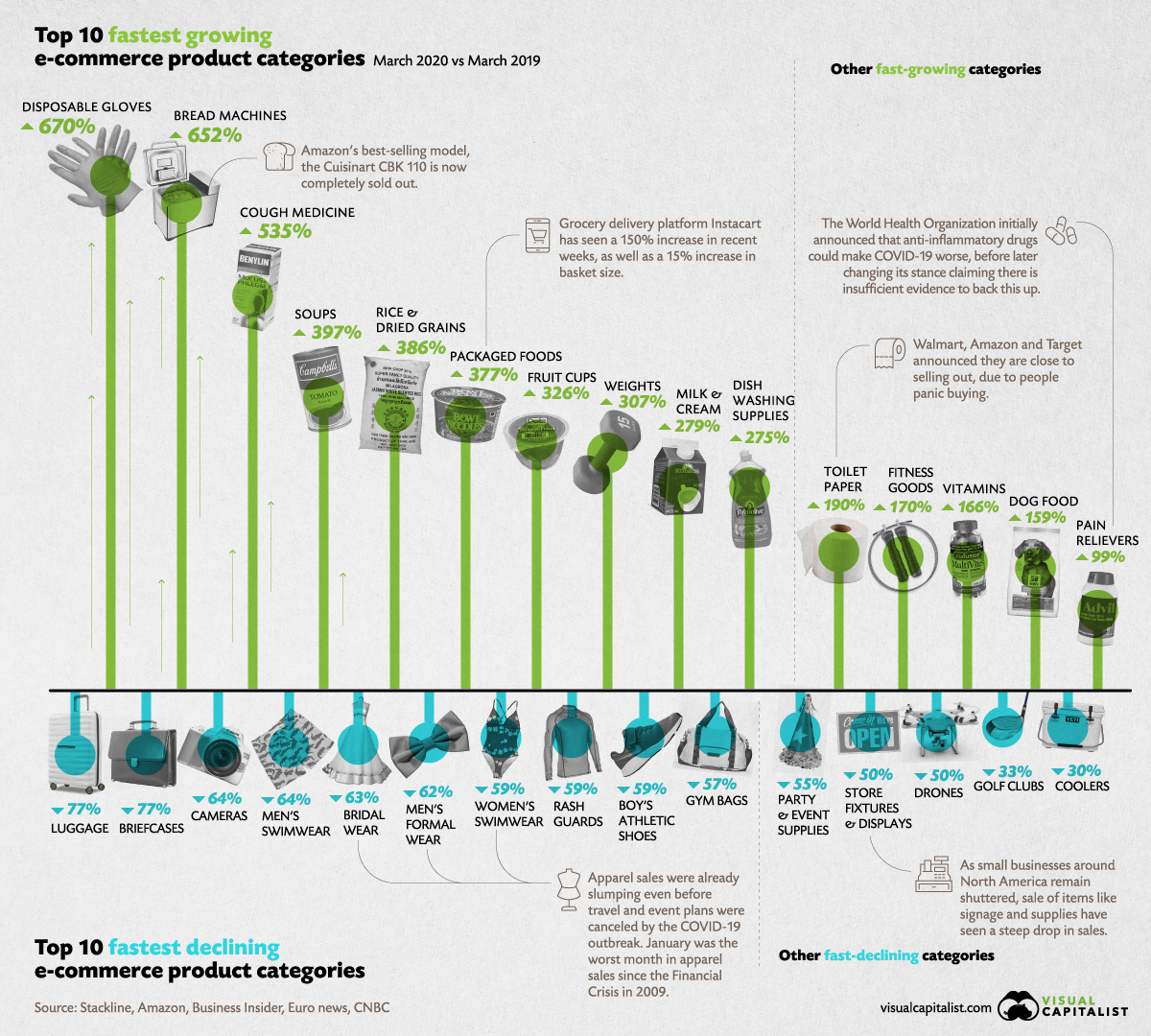

The Fastest Growing and Declining E-Commerce Categories

The COVID-19 pandemic is having a significant impact on every aspect of life, including how people shop for their necessities, and their not-so-necessities.

With online retail sales estimated to reach an eye-watering $6.5 trillion by 2023, the ecommerce sector was already booming. But since the outbreak, online shopping has been catapulted into complete overdrive. Even the largest retailers on the planet are struggling to keep up with the unprecedented consumer demand—but what exactly are people buying?

To answer this question, retail intelligence firm Stackline analyzed ecommerce sales across the U.S. and compiled a list of the fastest growing and declining ecommerce categories (March 2020 vs. March 2019) with surprising results.

The Frenzy of Buyer Behavior

As people come to terms with their new living situations, their buying behavior has adapted to suit their needs. While panic buying may have slowed in some countries, consumers continue to stock up on supplies, or “pandemic pantry products”.

Many consumers are also using their newfound time to focus on their health, with 85% of consumers taking up some kind of exercise while in social isolation, and 40% of them saying they intend to keep it up when restrictions are lifted.

These changing behaviors have resulted in a number of product categories experiencing a surge in demand — and although a lot of them are practical, others are wonderfully weird.

The Fastest Growing Categories

While the below list features several shelf-stable items, it seems as though consumers are taking matters into their own hands, with bread making machines sitting in second place and retailers selling out of their top models.

It’s clear from the list that consumers are considering positive changes to their lifestyle while in isolation, as fitness, smoking cessation, and respiratory categories are all experiencing growth.

Explore the 100 fastest growing product categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Disposable Gloves | 670% |

| #2 | Bread Machines | 652% |

| #3 | Cough & Cold | 535% |

| #4 | Soups | 397% |

| #5 | Dried Grains & Rice | 386% |

| #6 | Packaged Foods | 377% |

| #7 | Fruit Cups | 326% |

| #8 | Weight Training | 307% |

| #9 | Milk & Cream | 279% |

| #10 | Dishwashing Supplies | 275% |

| #11 | Paper Towels | 264% |

| #12 | Hand Soap & Sanitizer | 262% |

| #13 | Pasta | 249% |

| #14 | Vegetables | 238% |

| #15 | Flour | 238% |

| #16 | Facial Tissues | 235% |

| #17 | Allergy Medicine | 232% |

| #18 | Women’s Health | 215% |

| #19 | Cereals | 214% |

| #20 | Power Generators | 210% |

| #21 | Laundry Supplies | 200% |

| #22 | Household Cleaners | 195% |

| #23 | Soap & Body Wash | 194% |

| #24 | Toilet Paper | 190% |

| #25 | Jerky & Dried Meats | 187% |

| #26 | Chips & Pretzels | 186% |

| #27 | Crackers | 184% |

| #28 | Health Monitors | 182% |

| #29 | Popcorn | 179% |

| #30 | Computer Monitors | 172% |

| #31 | Fitness Equipment | 170% |

| #32 | Single Vitamins | 166% |

| #33 | Nut & Seed Butters | 163% |

| #34 | Cat Food | 162% |

| #35 | Fruit Snacks | 162% |

| #36 | Baby Care Products | 162% |

| #37 | Refrigerators | 160% |

| #38 | Baking Mixes | 160% |

| #39 | Toilet Accessories | 160% |

| #40 | Dog Food | 159% |

| #41 | Diapers | 154% |

| #42 | Yoga Equipment | 154% |

| #43 | Bottled Beverages | 153% |

| #44 | Baby Meals | 153% |

| #45 | Cookies | 147% |

| #46 | Digestion & Nausea | 144% |

| #47 | Snack Foods | 141% |

| #48 | Herbal Supplements | 136% |

| #49 | Cooking Oils | 135% |

| #50 | Water | 130% |

| #51 | Incontinence & Tummy | 129% |

| #52 | Mutivitamin | 126% |

| #53 | Cat Litter | 125% |

| #54 | Training Pads and Trays | 125% |

| #55 | Juices | 125% |

| #56 | Smoking Cessation | 122% |

| #57 | Dried Fruit & Raisins | 120% |

| #58 | Salt & Pepper Seasoning | 118% |

| #59 | Craft Kits & Projects | 117% |

| #60 | Batteries | 116% |

| #61 | Trash Bags | 116% |

| #62 | Nuts & Seeds | 116% |

| #63 | Hair Coloring | 115% |

| #64 | Sauce & Gravy | 115% |

| #65 | Deli Foods | 114% |

| #66 | Syrups | 114% |

| #67 | Breads & Bakery | 114% |

| #68 | Minerals | 113% |

| #69 | Condiments | 111% |

| #70 | First Aid | 108% |

| #71 | Nail Care | 108% |

| #72 | Humidifiers | 105% |

| #73 | Art Paint | 104% |

| #74 | Office Chairs | 104% |

| #75 | Deodorant | 103% |

| #76 | Jams, Jellies & Spreads | 102% |

| #77 | Coffee | 101% |

| #78 | Spices & Seasoning | 100% |

| #79 | Skin Care | 99% |

| #80 | Pain Relievers | 99% |

| #81 | Cooking Vinegars | 98% |

| #82 | Air Purifiers | 97% |

| #83 | Granola & Nutrition Bars | 97% |

| #84 | Pudding & Gelatin | 97% |

| #85 | Toy Clay & Dough | 95% |

| #86 | Single Spices | 95% |

| #87 | Bird Food & Treats | 91% |

| #88 | Lab & Science Products | 90% |

| #89 | Eczema & Psoriasis | 90% |

| #90 | Ping Pong | 89% |

| #91 | Chocolate | 86% |

| #92 | Baking Ingredients | 84% |

| #93 | Energy Supplements | 84% |

| #94 | Respiratory | 82% |

| #95 | Office Desks | 82% |

| #96 | Potty Training Supplies | 82% |

| #97 | Herbs, Spices & Seasonings | 82% |

| #98 | Keyboard & Mice | 80% |

| #99 | Body Lotion | 79% |

| #100 | Safes | 69% |

Interestingly, toilet paper has seen more growth than baby care products, and cured meats have seen more growth than water. But while some categories are experiencing a drastic increase in demand, others are slumping in the pandemic economy.

The Fastest Declining Categories

An unprecedented wave of event and vacation cancellations is having a huge impact on the products people consume. For instance, luggage and suitcases, cameras, and men’s swimwear have all seen a dip in sales.

See the full list of 100 fastest declining categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Luggage & Suitcases | -77% |

| #2 | Briefcases | -77% |

| #3 | Cameras | -64% |

| #4 | Men’s Swimwear | -64% |

| #5 | Bridal Clothing | -63% |

| #6 | Men's Formal Wear | -62% |

| #7 | Women’s Swimwear | -59% |

| #8 | Rash Guards | -59% |

| #9 | Boy’s Athletic Shoes | -59% |

| #10 | Gym Bags | -57% |

| #11 | Backpacks | -56% |

| #12 | Snorkelling Equipment | -56% |

| #13 | Girl’s Swimwear | -55% |

| #14 | Baseball Equipment | -55% |

| #15 | Event & Party Supplies | -55% |

| #16 | Motorcycle Protective Gear | -55% |

| #17 | Camera Bags & Cases | -54% |

| #18 | Women’s Suits & Dresses | -53% |

| #19 | Women’s Boots | -51% |

| #20 | Cargo Racks | -51% |

| #21 | Women’s Sandals | -50% |

| #22 | Drones | -50% |

| #23 | Boy's Active Clothing | -50% |

| #24 | Lunch Boxes | -50% |

| #25 | Store Fixtures & Displays | -50% |

| #26 | Automotive Mats | -50% |

| #27 | Men’s Outerwear | -49% |

| #28 | Watches & Accessories | -49% |

| #29 | Cargo Bed Covers | -48% |

| #30 | Track & Field Equipment | -48% |

| #31 | Ceiling Lighting | -47% |

| #32 | Camera Lenses | -47% |

| #33 | Girl’s Coats and Jackets | -47% |

| #34 | Women’s Hats & Caps | -47% |

| #35 | Women's Outerwear | -47% |

| #36 | Video Cameras | -46% |

| #37 | Wheels & Tires | -46% |

| #38 | Motorcycle Parts | -45% |

| #39 | Women’s Wallets | -45% |

| #40 | Shocks & Struts | -44% |

| #41 | Transmission & Parts | -44% |

| #42 | Girl’s Athletic Shoes | -44% |

| #43 | Women’s Shoes | -44% |

| #44 | Telescopes | -44% |

| #45 | Sunglasses & Eyeglasses | -43% |

| #46 | Men’s Tops | -41% |

| #47 | Video Projectors | -40% |

| #48 | Men’s Athletic Shoes | -40% |

| #49 | Marine Electronics | -40% |

| #50 | Hand Tools | -40% |

| #51 | Wine Racks | -40% |

| #52 | Men's Shoes | -40% |

| #53 | Clocks | -39% |

| #54 | Baby Girl’s Shoes | -39% |

| #55 | Bracelets | -39% |

| #56 | Men’s Boots | -39% |

| #57 | Tapestries | -39% |

| #58 | Camping Equipment | -39% |

| #59 | Men’s Bottoms | -38% |

| #60 | Cell Phones | -38% |

| #61 | Tool Storage & Organizers | -38% |

| #62 | Necklaces | -38% |

| #63 | Swimming Equipment | -37% |

| #64 | Men’s Hats & Caps | -37% |

| #65 | Girl’s Shoes | -37% |

| #66 | Industrial Tools | -36% |

| #67 | Juicers | -36% |

| #68 | Desktops | -35% |

| #69 | Classroom Furniture | -35% |

| #70 | Bar & Wine Tools | -35% |

| #71 | Glassware & Drinkware | -35% |

| #72 | Musical Instruments | -34% |

| #73 | Power Winches | -34% |

| #74 | Home Bar Furniture | -34% |

| #75 | Office Storage Supplies | -34% |

| #76 | Girl's Active Clothing | -34% |

| #77 | Women’s Tops | -34% |

| #78 | Braces, Splints & Supports | -34% |

| #79 | Car Anti-theft | -34% |

| #80 | Rings | -34% |

| #81 | Blankets & Quilts | -33% |

| #82 | Women's Athletic Shoes | -33% |

| #83 | Kitchen Sinks | -33% |

| #84 | Golf Clubs | -33% |

| #85 | Equestrian Equipment | -33% |

| #86 | GPS & Navigation | -32% |

| #87 | Recording Supplies | -32% |

| #88 | Home Audio | -32% |

| #89 | Boy's Accessories | -32% |

| #90 | Earrings | -32% |

| #91 | Dining Sets | -31% |

| #92 | Calculators | -31% |

| #93 | Boy's Shoes | -31% |

| #94 | Volleyball Equipment | -31% |

| #95 | Strollers | -31% |

| #96 | Coolers | -30% |

| #97 | Sanders & Grinders | -30% |

| #98 | Men's Activewear | -29% |

| #99 | Living Room Furniture | -29% |

| #100 | Climbing & Hiking Bags | -28% |

Regardless of which list a product falls under, it is clear that the pandemic has impacted retailers of every kind in both positive and negative ways.

The New Normal?

Officially the world’s largest retailer, Amazon has announced it can no longer keep up with consumer demand. As a result, it will be delaying the delivery of non-essential items, or in some cases not taking orders for non-essentials at all.

This presents a double-edged sword, as the new dynamic that is bringing some retailers unprecedented demand could also bring about an untimely end for others.

Meanwhile, the question remains: will this drastic change in consumer behavior stabilize once we flatten the curve, or is this our new normal?

Maps

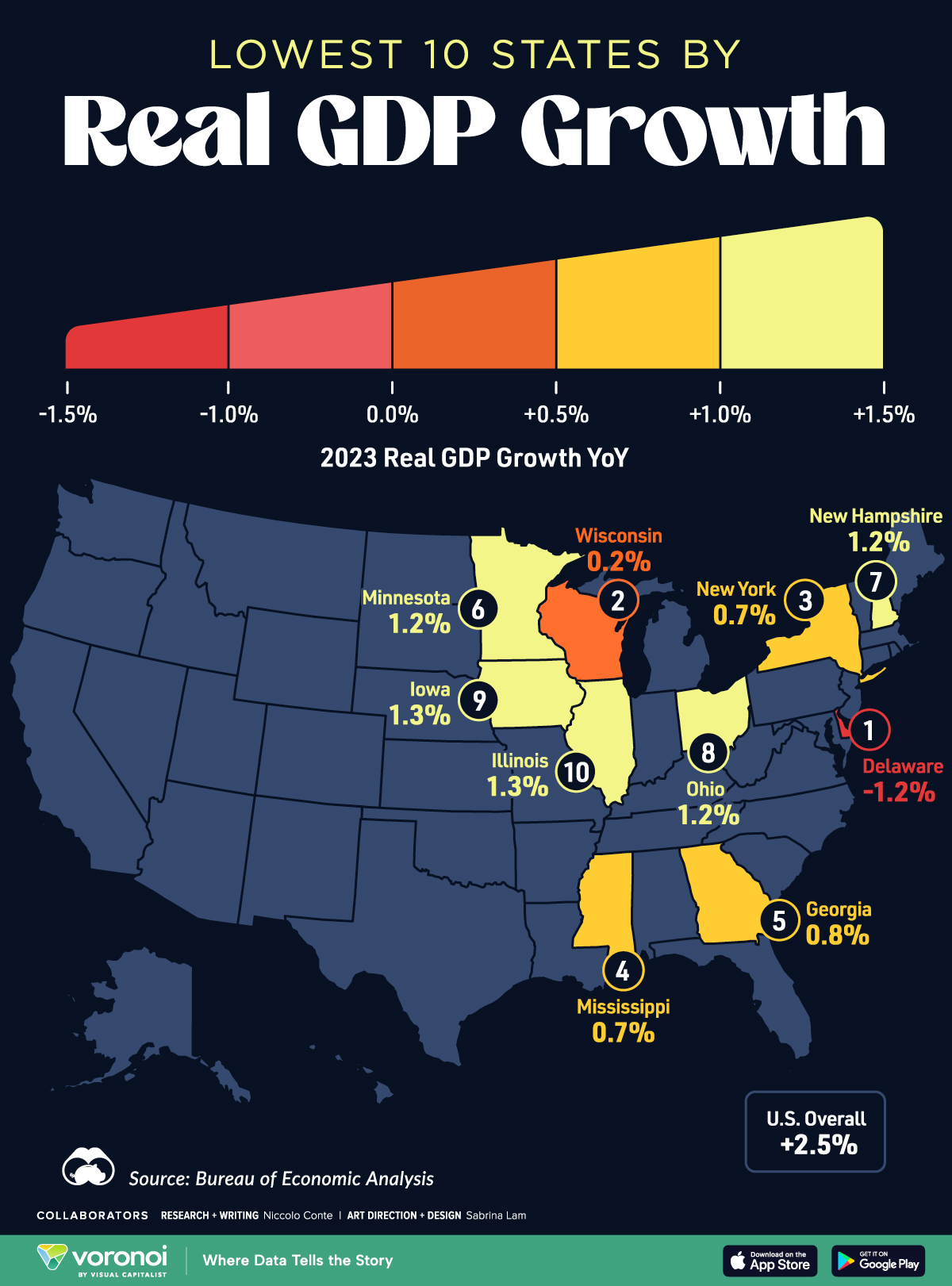

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country